Web3 for news publishers: What’s the long-term potential?

The merging of the physical and virtual dimensions of human interaction may feel like a future concept, but more and more publishers are getting their hands dirty with the new “realities” of Web3 and Metaverse. In an article-series dedicated to Future Technologies, we dive into what Web3 can mean for publishers. Stay tuned for next week’s post where we further explore “The Verse”.

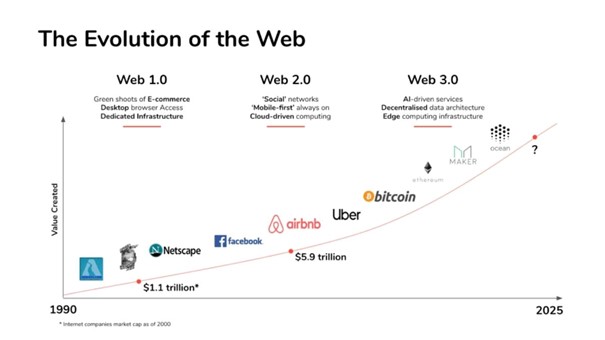

What is Web3 and how does it differ from Web2 and Web1?

Web3 is the third generation of the evolution of the internet and associated internet technologies. Web3 is based around the concept of decentralisation, with data stored securely across multiple devices and databases. This reduces the risk of data leaks and issues facing big datahubs. Data in Web3 is secured via blockchain technologies and token-based economics.

Compared to Web2 (the web of platforms that allow individuals to have online presence and make transactions, like Facebook or Airbnb) and Web1 (where only organisations could have an online presence), fans of Web3 suggest that once the blockchain trilemma is solved, it can be more secure, with greater scalability and privacy for users and reduced influence of large tech companies. In Web3, users can interact and make transactions with each other without the involvement of platforms or centralised organisations.

Source: Pragati Verma

How are publishers currently using Web3 technology?

The most known example of Web3 currently in use is NFTs. These Non-Fungible Tokens (NFTs) provide users proof of ownership of digital assets purchased with cryptocurrency by individual entries in a blockchain.

Many publishers like The South China Morning Post, Time, Gannett and The Economist have successfully experimented with creation of NFTs.

In March 2022, The South China Morning Post raised 250.000 USD by publishing all of their historic “front page” stories from 1997 through 13.000 NFTs. The sale and packaging of these NFTs was innovative and strategic as they were randomly packaged in equally priced mystery boxes. Each box contained five collectible pieces, and all NFT boxes were sold out in 5 hours. Lucky collectors obtained extremely rare front pages, which they will be able to add to their collection or resell for a substantial profit.

Following these results, The South China Morning Post announced a spin-off blockchain-based NFT business, ‘Artefact Labs’. Artefact Labs is based on the creation of an advanced multi-chain NFT ecosystem, with the objective of helping other media, historical and NFT systems around the world.

« Artefact labs has the mission to help other media, historical, and cultural institutions around the world step into Web3 through their preservation of their archives on the blockchain. In doing so, we hope to create many new business models that will sustainably fund the recording and protection of history. » – Gary Liu, CEO of South China Morning Post and Founder of Artefact Labs

This spring, following the launch of a successful NFT collection called TIMEPieces, TIME released the first-ever magazine issue available as an NFT. Holders could digitally read the issue thanks to a partnership with the LITDAO project. The project created the world’s first decentralised book. Through continuing their TIMEPieces project, the publisher hope to “push the boundaries as to where we can provide unique opportunities and value to our consumers.”

What are the long term benefits of Web3 for the publishing industry?

Whilst the South China Morning Post, TIME and many others have leveraged the short-term benefits of web3, there is much more potential.

An immutable preservation of information and more profitable business models

Most publishers currently consider the price of archiving and preservation on a regular basis. As archives grow, the cost of fighting degradation and the risk of data loss increase. Additionally, the points of failure that could lead to catastrophic data loss are currently heavily centralised. Blockchain may mitigate these risks and costs, making centralised archives less relevant. This is because it would enable publishers to record and publish articles via an immutable ledger. This would provide long term security, preservation and greater accountability to news media. Here, the public will also be able to benefit from a decentralised record of what has been published.

Historical archives of news organisations are largely hidden, with some exceptions given via libraries or enterprise licensing and subscription models. Furthermore, the content of news media archives is now sold at a price that perpetually undervalues it since digital media currently has little intrinsic value. Monetisation is mostly being based on subscriptions and brand loyalty. But what if digital media could create enough value for these assets to be owned and traded through formats like micropayments?

The appreciation and royalties of historical NFTs

While the market may not value everything that publishers produce, publishing organisations may always find investors to fund their pursuits through ownership. As stories become more significant in time, assets can become more valuable, allowing publishers to benefit from their value appreciation. NFT holders can also benefit from the royalty payments of every future trade for a given NFT. The verifiable scarcity of these digital assets could generate intrinsic value to news-media as they may become exclusively owned and traded, while remaining available for everyone.

As readers feel more part of the business, subscriber retention may increase. Customers may feel a need to feel included in the business to maximise their own financial gains when trading. Having touched upon subscriptions, in the long run, NFTs may also have the potential to validate memberships of news subscribers as well as the intellectual property of media content.

Monetising stories as NFTs

A much-debated topic for publishing is putting stories on sale as NFTs and seeing what new success this can bring. The idea behind this is that highly performing pieces will receive more demand. As a result, this demand will see works receive payment multiple times for access and engagement. Readers engaging with such stories by purchasing part of the NFT associated with it could generate further value for the author. Leveraging their own social networks, such as through sharing, would not only enrich the social value in the network of the reader, but would bring a tangible monetisation to the author.

The value of the article will be determined by the level at which the audience appreciates the content and are willing to pay for it. Clearly, this is a way for journalists to be directly rewarded for the value of their work.

Potential for micropayments with the adoption of the lightning network

With cryptocurrencies being adopted at a faster rate than the internet, in the very near future layer 2 solutions like The Lightning Network could potentially enable micro-payments. With lightning network offering transaction costs at the fraction of a price of normal transactions, the debate around micropayments in publishing could be reopened. This would mean that access to individual articles through crypto wallets could become a reality, and offer another level of monetisation for publishers. It would remove the problem of early cancellation to single article access and enable publishers to monetise their content without losing readers to free access competitors. Perhaps there is more potential for publishers to reap rewards here rather than monetising stories as NFTs.

The lightning network also provides the chance for monetisation through smart contracts. With these contracts, publishers could get a financial return whenever a story is shared on social media. In 2021, Twitter introduced the concept as a way to tip creators on their profile to say thanks for their work.

Validating digital assets through NFTs

A recent podcast episode of Freakonomics Radio saw Stephen Dubner, highlighted the potential of NFTs to validate digital assets. A pertinent example given is the case of event tickets. When big events are launched artists and teams tend to receive a fraction of the profits, with resellers buying and then profiting from large amounts of tickets. If tickets were sold as NFTs, Eric Budish, Economist at the University of Chicago explained that artists or teams would have control of the ticket from the moment of sale to the event.

This would allow the seller to keep more money for themselves, but also have a huge impact on stopping counterfeit tickets. Reselling would have to be confirmed at the point of transfer and the legitimacy of the ticket could be seen in the NFT. A shift like this would see effective validation of digital assets and prevent ticket fraud, like we saw at 2022’s Champions League final in Paris where around 3,000 fake tickets were identified.

Publishers can learn from this as well in their efforts to validate the authenticity of news. Entering into direct relationships between publishers and readers can limit piracy of news and even aim to help subscribers rebuild trust in news brands.

What threats and limitations are foreseen in Web3?

While these are all possibilities, there are several threats and limitations. Monetisation of stories could work for publishers, but it could also turn into another way of enabling the creator economy. Individual journalists and influencers could build their own following monetised completely by NFTs thanks to the popularity of their work. This would be like the next step on the ladder of the Substack revolution. We are also in the midst of a cryptocurrency winter. Whilst there is already money and movement in the Web3 world, the price of cryptocurrencies have dropped significantly, and with its unregulated nature there is nothing stopping this from repeating itself.

Limitations come mainly in the form of contradictory technical and conceptual problems that only time will help to unfold. Amongst these, the degree of decentralisation of the blockchain still ignites several debates. This is particularly with regards to how immutability could be challenged depending on how the implementations and protocols of blockchain will evolve. Moreover, while current NFT marketplaces provide authentication and ownership, they may arguably not yet provide the necessary guarantees of significance and provenance to create proper value. This often calls for an additional layer of validation, which relies on human expertise. For now, this expertise is currently not evenly defined across different selling platforms.