“Subscribers who convert during the pandemic are likely to remain”: Publishers continue to see a surge in subscriptions, with low rates of churn

People all over the world are consuming more content as they stay indoors. And they are not limiting themselves to free content but are paying for subscriptions in record numbers, even though many publishers have taken down paywalls.

While the surge in new subscriptions peaked in March, it continues to be higher than pre-pandemic levels.

Will this growth last? Experts seem to think so. “[A pandemic] is long enough for a behavior to take hold,” says Cynthia Kent Machata, Head of Planning at Havas Media Group.

The same has also been validated by a study done by Phillippa Lally, a health psychology researcher at University College London. Lally found that it can take anywhere from 18 to 254 days for people to form a new habit. But on average, it takes a little over 2 months before a new behavior becomes automatic.

4x growth in subscriptions

New subscriptions jumped as much as 97% in late March among US publishers that use the subscription platform Piano, reports MediaPost. According to Piano, global subscription volumes surged more than 80% above those seen in the months prior to the pandemic.

Although growth eased in May, it “remains highly elevated.” Two months after the start of the surge, subscription volume was still 44% above the pre-pandemic baseline in May.

Bloomberg Media is still seeing 4x growth in subscriptions compared to its historical daily average. This despite the surge in traffic slowly subsiding.

The pandemic and its impact on the global economy isn’t going away anytime soon. We’re uniquely positioned with our global business content to be a critical resource for people navigating the world now and for months to come.

“Less likely to cancel as they get accustomed to paying”

Publishers are concerned whether the new subscribers would stay, given how the pandemic has hurt the economy, and that it is being widely covered with critical information available for free.

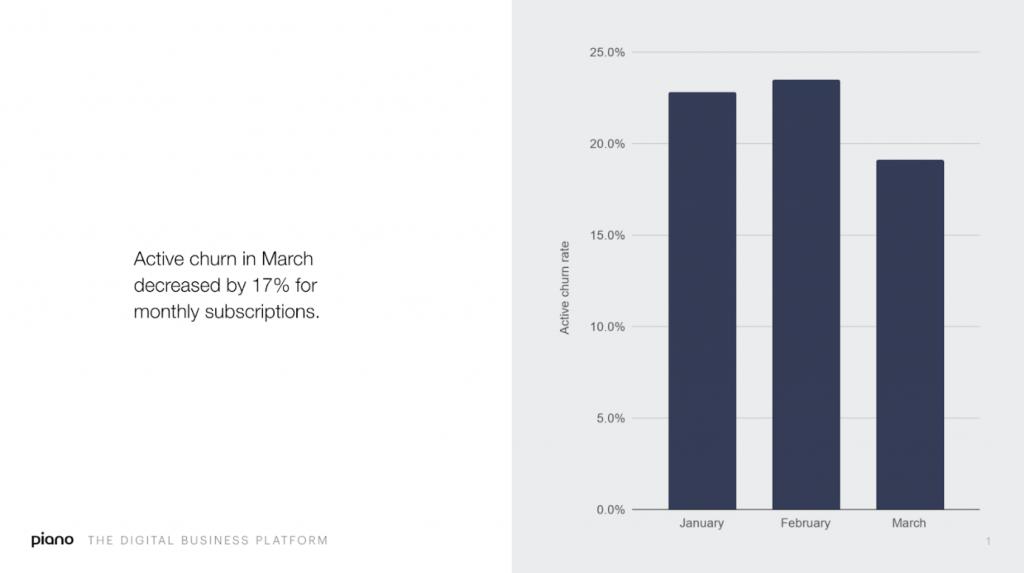

However, data from Piano shows that cancellations of monthly subscriptions acquired in March dropped an average of 17% compared to subscribers acquired in January and February. Churn dropped by about 34% in Europe, whereas in the US it was flat overall.

“Even flat churn is impressive,” Piano’s SVP of Strategy, Michael Silberman, told Digiday. “Given the big increase in new subscriptions during March.

“It demonstrates the value readers place on quality journalism during the pandemic and their willingness to pay for it.”

Data from April also suggests churn performance will be similar to March. “Because most churn occurs in the days and months just after a subscriber converts,” the Piano article states, “with subscribers becoming much less likely to cancel as they get accustomed to paying.”

These early churn numbers provide good reason to believe subscribers who convert during the pandemic are likely to remain subscribers over the longer term.

“While the news environment will change as it always does,” says The New York Times COO Meredith Kopit, “we expect that the larger number of registered readers and our growing effectiveness at getting them to return and form a habit will mean an improvement in the underlying rate of net additions versus the period prior to the crisis.” The publisher increased digital subscription by a record 587,000 in the first quarter.

A Guardian spokesperson noted that readers who signed up as subscribers after President Trump’s election and the Cambridge Analytica story have largely stayed back. The publisher had 821,000 recurring monthly supporters in March, and added another 50,000 in April.

Each of the different levels of Guardian support, like patrons, members and digital subscriptions, have shown two to three times faster growth than usual.

“The same principles apply now as they always have”

These developments provide “all the more reason for print and digital publishers to improve their ability to track consumers during this pivotal time,” comments Adweek’s Publishing Editor, Sara Jerde.

Publishers that are able to learn what their new audience does (or doesn’t) look like and can most effectively communicate that to advertisers and potential partners will be in a position of strength.

“Everybody is thinking about [retention],” says Silberman, “and we’ve been advising on some tactics to track users who have subscribed in March and April so that they can be emailed and messaged on-site to drive engagement.

“The same principles apply now as they always have: Find ways to deliver value, develop habits and remind subscribers about the value of the product.”

“What you do well and why people come to you”

Robbie Kelman Baxter, Media Consultant and the author of The Forever Transaction, suggests examining previous spikes, and identifying the readers who stayed and who left. Comparing the behavior of those who stayed with those who left in the hours, days and weeks after sign-up would yield valuable insights for retention strategies.

Baxter added that the pandemic also provides publishers with new opportunities to serve readers as their lives have been disrupted. This makes them more open to experimentation.

It’s never been more important to understand what you do well and why people come to you, from an editorial and a revenue perspective.

“Tenfold increase in newsletter signups”

For example, print newspaper readers are showing higher digital engagement in recent months, according to Piano data, so encouraging them to activate online access is an important tactic.

The Philadelphia Inquirer did so with full-page newspaper ads and emails to print subscribers that guided readers to their site. This led to doubling of the publisher’s average print activation rates and a tenfold increase in newsletter signups from print ads.

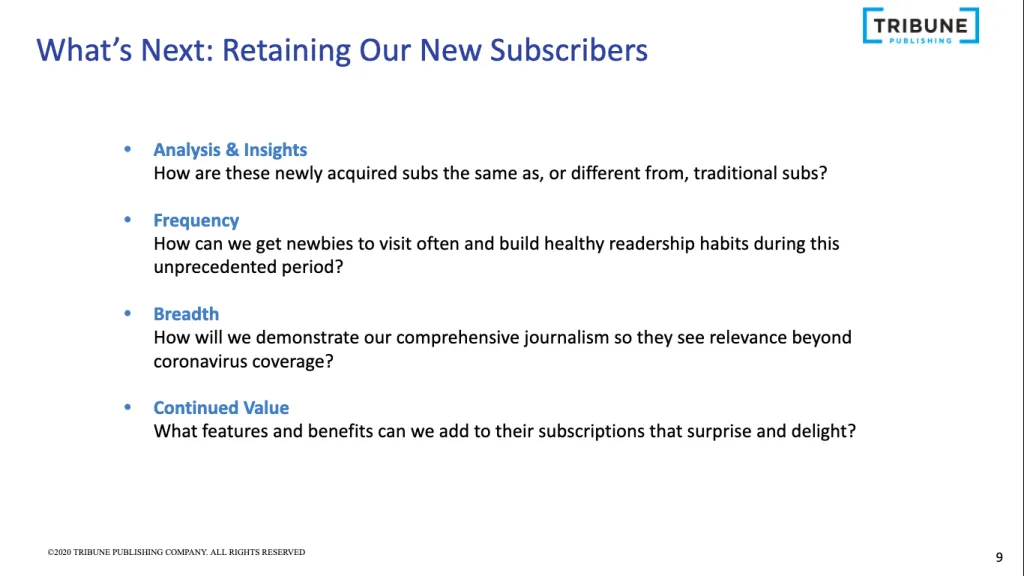

Tribune Publishing, which saw a 293% increase in subscriptions in March, compared to February, is using data to understand its subscribers better.

Source: Digiday

The publisher is also demonstrating the breadth of its content to readers by promoting non-coronavirus stories. The Guardian is doing the same by sharing a list of 10 of its most-well read non-coronavirus articles everyday.

It has also ramped up tests of its registration wall to its global audience with more users spotting it over the past few weeks. According to the publisher, the registration wall is part of a series of tests that represented it’s “ongoing strategy to develop a deeper set of relationships with our readers.”

“Winners will be able to capitalize on that surge”

While acknowledging the challenges the pandemic poses on the revenue front, Ken Doctor, President of Newsonomics, suggests that publishers who invest in high-quality, and differentiated content will convince readers that journalism is worth paying for.

This is supported by Piano data. The company found that quality editorial is helping boost retention, with subscribers generating 41% more pageviews than they did in the pre-pandemic period

“This is a one-time event that you’re seeing this surge of information,” says Andre James, Partner and Director at Bain & Company.

Winners will be able to capitalize on that surge and adjust their offerings even as the crisis continues.

“Reader revenue only becomes the dominant force if you earn it,” concludes Doctor.